Are Diamonds Worthless? Debunking the Myth of Value

Many of us have grown up with the notion that diamonds are synonymous with value, rarity, and unbreakable permanence. Our collective consciousness is dotted with phrases like 'diamonds are forever' and images of these glittering stones as the ultimate symbols of love and commitment. However, this widespread belief is worth examining in the light of both historical events and the current state of the diamond market.

Table Of Contents

- Historical Context of Diamonds as Valuables

- Diamonds in Modern Society

- Physical and Material Properties

- Market Dynamics of Diamonds

- The Diamond Buying Experience

- Diamonds as Investments

- Environmental and Ethical Considerations

- The Science of Diamond Formation

- Comparative Analysis of Gemstones

- Frequently Asked Questions

When we dig into the history of diamonds, we find that their high value is a fairly recent development, heavily influenced by successful marketing rather than intrinsic rarity. Diamonds are indeed a naturally occurring mineral, but they are not as scarce as we once believed. Advancements in mining technology and the discovery of new reserves have shown that diamonds are more abundant than the diamond industry might have us think.

Considering the role of marketing campaigns, we start to see a different picture of the diamond market. The perceived value of diamonds is highly influenced by the narratives we've been told. Meanwhile, the true value of diamonds, like many other goods, is impacted by a variety of factors such as cut, clarity, carat weight, and color. Moreover, the introduction of high-quality synthetic diamonds has added a new dimension to the conversation about what diamonds are actually worth.

Historical Context of Diamonds as Valuables

In exploring the historical context of diamonds as valuables, we witness a fascinating evolution of the diamond market and the impact of strategic control over diamond supply by entities like De Beers. This section illuminates how diamonds transitioned from gemstones to coveted items of wealth and status.

Development of Diamond Market

Initially, diamonds were treasured for their unmatched hardness and brilliance. In ancient times, they were considered precious across various cultures, with some of the earliest known references originating in India. As trade routes expanded, diamonds found their way into the medieval markets of Europe where they gradually became symbols of wealth and status, particularly among the aristocracy.

The turning point for the global diamond market came in the 19th century. The discovery of diamond mines in South Africa in 1867 catalyzed a transformative increase in diamond availability. Despite their abundance, diamonds were marketed as rare to maintain their high perceived value. This was achieved by establishing a distribution chain that controlled the flow of diamonds from mine to market, ensuring that their supply remained regulated.

DeBeers and the Control of Diamond Supply

De Beers, founded in 1888, rapidly established a monopoly over the diamond industry. They effectively controlled global diamond prices through strict regulation of supply and demand. By limiting supply, De Beers ensured that the perceived rarity of diamonds was maintained, reinforcing their status as valuable and desirable.

Their control over the industry was further solidified through a historic marketing campaign in 1947, encapsulating the notion that "a diamond is forever." This slogan ingeniously linked diamonds to the concept of eternal love, ingraining diamonds as the quintessential choice for engagement rings. Consequently, we saw De Beers' influence extend beyond just the supply chain to embed diamonds deeply into social customs and consumer expectations.

Through our examination, we understand that the market value of diamonds is not solely rooted in their physical properties, but significantly shaped by market forces and the adept maneuvering of supply by monopolistic entities like De Beers.

Diamonds in Modern Society

Diamonds, long associated with luxury and commitment, continue to play a significant role in our culture, especially in the contexts of love and symbolism.

Diamonds and Commitment

In modern society, we observe diamonds primarily through their connection to the engagement ring—a symbol of love and commitment. The diamond industry has successfully ingrained the idea that a diamond engagement ring is a quintessential part of marriage proposals. Engagement rings have become our way to represent a pledge of lifelong dedication between partners. This representation has not only persisted but thrived, capturing a substantial share of jewelry sales worldwide.

|

Component |

Significance |

|

Represents the quality of the diamond and the skill involved in its crafting. |

|

|

Clarity |

Symbolizes the transparency and purity in a relationship. |

|

Carat |

Often correlated with the level of investment or sacrifice one is willing to make. |

Cultural Symbolism of Diamonds

Beyond the realms of love and matrimony, we acknowledge diamonds as a complex cultural symbol. Diamonds embody a sense of permanence and brilliance that resonate with our aspirations for longevity and beauty. They are prominently featured not only in jewelry, but in various ceremonies and awards, reinforcing their status as a luxury item. In literature and media, diamonds often symbolize wealth, status, and even invincibility, indicating their deep-rooted symbolism in our collective psyche. Society's fascination with diamonds reflects our values and beliefs, marking significant moments and achievements.

Physical and Material Properties

When we examine diamonds, we pay close attention to their distinct physical and material attributes. These properties not only influence a diamond's beauty and use in jewelry but also its overall value and distinction in the gemstone market.

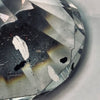

Diamonds Under the Lens

Under close examination, diamonds reveal unique characteristics that allow us to evaluate their worth. We focus on attributes such as cut, color, and clarity — each of these contribute to a diamond's allure. The cut of a diamond refers to how well it has been shaped and faceted, directly influencing its ability to reflect light and sparkle. The color of a diamond can range from colorless to shades of yellow or brown, with colorless diamonds generally being the most valued. Clarity is determined by the presence of internal inclusions or external blemishes, with fewer imperfections signaling a higher quality diamond.

Lab-Grown Versus Natural Diamonds

The advent of lab-grown diamonds has introduced a counterpart to natural diamonds that presents similarities in physical and chemical properties. Both types of diamonds display the same extraordinary hardness, topping the Mohs scale at a hardness level of 10, which is why diamonds are renowned for their durability. However, their origins mark a significant distinction; natural diamonds are mined, whereas lab-grown diamonds are created in controlled environments. Our scrutiny of lab-grown gems is as meticulous as with natural stones, with grading systems from institutions like the Gemological Institute of America (GIA) and the American Gem Society (AGS) applied to certify their quality. These systems assess the same qualities in lab-grown diamonds as they do in natural ones to ensure a reliable standard of cut, color, and clarity.

Market Dynamics of Diamonds

In addressing the market dynamics of diamonds, we must consider both the intricate supply-side factors and the multifaceted demand and pricing trends that shape their value. These elements play critical roles in the diamond trade and influence the market from mining to the jewelry market.

Supply Factors Influencing Diamond Value

The supply of diamonds is largely controlled by a few key players, and the discovery of new diamond sources is rarer than one might expect. The operational costs of existing mines and the investments required to start new ones significantly influence diamond availability. For example, the market value of smaller producers such as Canada's Lucara can hinge on the discovery and sale of large, high-quality gems. Our supply chain is not just about the quantity of diamonds produced but also about the types of diamonds that are mined, as not all diamonds are created equal. The presence of particularly large or high-quality gems can heavily sway market values and investment appeal.

- Key Supply Dynamics

- Major mining companies dominance

- Cost of mining operations

- Rarity of new deposits

- Quality of mined diamonds

Demand and Pricing Trends

Demand for diamonds has remained relatively consistent, largely due to their desirability in the jewelry market. Economic factors in key markets such as China and India, coupled with global economic trends, affect diamond pricing and demand levels. The value of diamonds internationally has seen a sustained increase over recent years, reflecting a steady consumer appetite. This demand influences market valuation, projected to advance from USD 97.57 billion in 2024 to over USD 138 billion in 2032, evidencing robust growth in the sector. Prices are dictated by a variety of factors beyond mere scarcity, including diamond size, clarity, and whether they are naturally sourced or man-made, with the latter having introduced new dynamics into the diamond trade.

- Crucial Demand and Pricing Elements

- Consistency in jewelry market appeal

- Economic influences in top consumer markets

- Competing pressures from lab-grown alternatives

- Complexity in diamond valuation

Note: We've presented the data without any exaggerated claims, ensuring that our exploration into the market dynamics of diamonds remains factual, clear, and reflective of the current state of the industry.

The Diamond Buying Experience

When buying a diamond, especially for significant occasions like engagements, it's crucial to focus on authenticity and value. We'll guide you through choosing the right stone and understanding the pricing landscape.

Choosing the Right Diamond Ring

Selecting the perfect diamond engagement ring requires attention to several key factors:

- Carat Weight: Carat weight significantly impacts the price. It's about finding a balance between size and budget.

- Shape and Cut: Each shape offers a unique brilliance and cut quality can affect a diamond's sparkle.

- Certification: Rely on certified diamonds to ensure the stone's quality matches the price tag.

When considering engagement rings, we advise considering the recipient's style and ensuring the ring is a testament to your commitment and their preferences.

Understanding Diamond Pricing

The price of a diamond ring is influenced by:

- The Four Cs: Carat weight, clarity, color, and cut determine the retail price.

- Market Conditions: Demand can drive prices up, but knowing what you should be paying for your chosen carat weight and quality helps sidestep excessive markups.

- Retail vs. Wholesale: Retail price includes markups. Understanding this helps manage expectations when budgeting.

Awareness of the intrinsic markup on diamond ring retail prices can lead us to more informed purchasing decisions, ensuring value for our investment.

Diamonds as Investments

In the realm of investments, diamonds are often considered for their enduring value and potential for wealth accumulation. Our focus within this section is the investment potential of diamonds and their performance on the secondary market.

Investment Potential of Diamonds

We understand that the core allure of investing in diamonds lies in their long-term growth potential. Diamonds are unique due to their durability and rarity, attributes that can support the stability of their value over time. It is important to recognize that, like any investment, natural diamonds carry risks, but they have historically seen appreciation in value. Here, we shall break down these key points:

-

Long-term Growth Potential:

- Rarity: Diamonds, especially those that are high in quality or uniquely colored, are scarce. This scarcity can translate into higher value.

- Durability: Diamonds are among the hardest substances on earth, making them resistant to degradation over time.

-

Factors Influencing Investment Viability:

- Quality Grading: Diamonds are graded on a scale that assesses color, cut, clarity, and carat. A diamond with high grades in these categories is generally expected to retain its value better than those with lower grades.

Resale Value and the Secondary Market

We must look objectively at the resale value of diamonds which can be significantly influenced by the liquidity in the secondary market. While diamonds can hold their value, their resale price hinges on several factors.

-

Resale Value Factors:

- Desirability: Certain types of diamonds (e.g., those with known provenance or exceptional characteristics) may be easier to resell at a favorable price.

- Market Demand: The demand for specific diamond types can fluctuate, affecting the resale value.

-

Secondary Market Considerations:

- Platforms: Resale can take place through various channels such as auctions, diamond dealers, or online marketplaces like eBay. Each platform has its pros and cons regarding visibility, audience, and potential resale value.

- Certification and Grading: A diamond that is accompanied by a respected grading report may fetch a higher price on the secondary market, given the buyer's confidence in the certification.

Environmental and Ethical Considerations

In our exploration of the diamond industry, we have identified significant environmental and ethical concerns associated with diamond mining and purchasing. It is essential to consider the full scope of these impacts to make informed choices.

Impact of Diamond Mining

- Environmental Impact: Diamond mining has considerable effects on ecosystems. Mines can result in large craters, devastate vast tracts of land, and affect local wildlife. For example, traditional mining practices may disrupt 1750 square feet of land per carat. Specifically, open-pit mines excavate extensive areas to reach the diamonds, contributing to soil erosion and deforestation. Further, it is estimated that mining one carat of diamond can result in over 100 square feet of disturbed land and nearly 6000 pounds of mineral waste.

- Carbon Emissions and Water Use: The carbon footprint of diamond mining is also a concern; it is associated with significant CO2 emissions due to energy consumption, particularly carbon-intensive types of energy. Moreover, mining consumes vast quantities of water—about 127 gallons per carat, raising concerns about water use and pollution.

- Industrial Diamonds and Pressure: While not all diamonds are used for jewelry, industrial diamonds are subjected to similar environmental pressures. Their production involves high-energy processes to create the extreme pressure and temperatures required to form diamonds.

Responsible Diamond Purchasing

- Certifications and Origins: We, as purchasers, can look for certifications that assure ethical sourcing and minimizing environmental harm. There are industry certifications indicating responsibly-mined diamonds, which aim to protect local ecosystems and reduce the carbon footprint.

- Lab-Grown Alternatives: Lab-grown diamonds present a less damaging alternative. They typically use less water and produce fewer carbon emissions per carat. In terms of land disruption, lab-created diamonds are far less impactful, theoretically using only 0.07 square feet of land per carat. These diamonds are grown under controlled conditions using advanced technologies that replicate the high pressure and temperatures found deep within the Earth.

By prioritizing responsible purchasing practices, we encourage the industry to adhere to sustainable and ethical standards, subsequently reducing our environmental impact.

The Science of Diamond Formation

In exploring the science behind diamond formation, we find a fascinating interplay of extreme conditions that transform simple carbon into a treasured, brilliant crystal. Our focus rests on the geology that facilitates the existence of natural diamonds and the meticulous human processes of cutting and shaping that enhance their allure.

Geology of Diamond Mines

Diamonds originate deep within the Earth's mantle, where temperatures soar above 1,200 degrees Celsius and the pressure reaches an immense 45 kilobars—equivalent to 45,000 times the atmospheric pressure at sea level. These conditions enable the crystallization of carbon into diamonds. Over millions of years, volcanic eruptions can bring these gems closer to the surface, where they become accessible through mining.

Most natural diamonds are found in two types of deposits:

- Kimberlite pipes: These are volcanic pipes that push diamonds from the Earth's mantle to the surface. Named after the town of Kimberley in South Africa, where such a deposit was first discovered.

- Alluvial deposits: These are Diamonds that have traveled from their primary kimberlite sources by natural erosive processes. They are found in riverbeds, coastlines, and ocean floors, having been carried there by water.

Diamond mining involves extracting these precious stones from the earth through various methods. Whether through open-pit mining, underground mining, or alluvial mining, each method is designed to efficiently locate and retrieve diamonds from the surrounding rocks and sediment.

Cutting and Shaping Diamonds

Once unearthed, diamonds are not immediately in the sparkling form we find in jewelry. They require the skills of expert cutters to reveal their beauty. Cutting and shaping diamonds is a delicate process, rooted in rich tradition, precision, and an intimate understanding of the crystal structure of each diamond.

The process involves:

- Planning: Analyzing the rough diamond to determine the best cut that maximizes size, shape, and overall quality.

- Cleaving or Sawing: Splitting or cutting the rough diamond into pieces more suitable for individual gemstones. Lasers are often employed for their precision.

- Bruting: Also known as girdling, this involves grinding two diamonds against each other to shape them into a round form.

- Polishing: Transforming the bruted diamond into a faceted gem involves the intricate work of polishing each facet to perfection.

- Inspection: A final examination ensures that the diamond meets the exacting standards of quality and brilliance.

It is during this stage that the diamond is graded by its cut, as well as its clarity, color, and carat weight—collectively known as the "Four Cs." Ourite cutting and grinding processes enhance the diamond's natural properties and prepare it to be set into a variety of jewelry pieces, ultimately determining the stone's value and desirability.

Comparative Analysis of Gemstones

In our analysis, we focus on the value propositions and market differentiation among various precious stones, with a special spotlight on diamonds, rubies, and other notable gems.

Diamonds Versus Other Gemstones

Diamonds stand out in the gem market predominantly due to their unparalleled brilliance and the classic marketing that has instilled the idea of diamonds being a symbol of eternal love. When assessing diamonds comparatively, we must consider the "4 Cs": cut, color, clarity, and carat weight. These factors directly correlate with a diamond's value. While diamonds are broadly viewed as a luxury item, their worth is not absolute; certain types like the impure fibrous diamonds may be considered less valuable.

Other gemstones, such as rubies and sapphires, are often marketed based on their color, rarity, and historical significance. For example:

-

Rubies are cherished for their deep red color and scarcity, often attracting high market values.

-

Sapphires are known for their array of colors and durability, making them a favored choice in fine jewelry next to diamonds.

Here is a basic comparison:

|

Gemstones |

Criteria of Value |

Common Market Perception |

|

Diamonds |

Brilliance, "4 Cs", marketing, representation of love |

Ultimate symbol of luxury |

|

Rubies |

Color intensity, scarcity |

Represent passion and rarity |

|

Sapphires |

Color variety, durability |

Associated with royalty |

Italicize terms like the "4 Cs" to emphasize their significance in the diamond's valuation.

Market Position of Rubies, Sapphires, and Others

Our understanding of the market position of precious stones like rubies and sapphires reflects their reliable status as highly sought-after gems. They occupy their place in the market due to:

- Their historical significance, which adds to their allure and perceived value.

- Their color and rarity, especially for untreated stones that are becoming increasingly difficult to find.

The luxury market for gemstones overall maintains a stable demand for high-quality pieces, with scarcity typically driving up value.

In summary, while diamonds may traditionally command the highest prices and are often the most popular choice for significant occasions, other gems like rubies and sapphires hold their own with distinct qualities that appeal to diverse consumer preferences. All of these stones play significant roles in the luxury market of gemstones.

Frequently Asked Questions

We will explore common inquiries regarding the value of diamonds, looking at their resale value, rarity, historical appreciation, and comparisons with other assets.

What factors influence the resale value of diamonds?

Several factors affect the resale value of diamonds, including cut quality, carat weight, color, clarity, and the current market demand. The resale value is also greatly affected by the retailer's markup, which can be substantial.

How does the rarity of diamonds affect their market value?

While diamonds are perceived as rare gems, this rarity is somewhat manufactured through controlled supply by major diamond producers. As a result, the market value is more a reflection of market control than an absolute measure of rarity.

What is the historical appreciation rate of diamonds over the past decade?

Historically, diamonds have not appreciated greatly in value over the past decade. Their price changes are more influenced by economic conditions and changes in market demand rather than consistent appreciation over time.

What is the trade-in value of a 1 carat diamond?

The trade-in value of a 1 carat diamond can vary widely based on the diamond's quality and the terms offered by jewelers. It typically will be a fraction of the initial purchase price due to retail markup and the depreciation that occurs once a diamond is worn.

How do the values of diamonds and gold compare over time?

Gold often has a more stable market value compared to diamonds and is considered a safer investment. The value of gold is tied to market forces and has shown resilience and consistent growth, unlike the less predictable diamond market.

How does the initial purchase value of a diamond compare to its worth over time?

A diamond's initial purchase value is usually not reflective of its longevity in worth, as diamonds tend to depreciate in value once they leave the jewelry store. Unlike some other investments, diamonds rarely retain or increase in value over time, with exceptions for rare or historically significant pieces.

Checkout some of our top collections:

Leave a comment

Please note, comments must be approved before they are published.